By: Nick Callos

Updated for the 2024 tax year!

Death and taxes. Even as a digital nomad, these things remain certain. But how exactly do you pay taxes as a digital nomad?

After all, you’ve earned income working from a laptop in multiple countries. And some of the clients you worked for may not even be located in the United States. I’ve made money for an American company while traveling in Southeast Asia, a Chinese company while living in the United States, and an Irish company while living in China.

As you can see, taxes for digital nomads get tricky. How do freelancers do taxes when traveling around the globe?

Worried? Don’t be. We’ll get to the bottom of everything in this digital nomad tax guide. Hopefully, we’ll answer all your questions about taxes for expats. If you have questions, join our community on Facebook and ask!

Disclaimer: The content in this article has been provided for informational purposes only. It should not serve as legal, tax, or accounting advice. Consult your certified public accountant (CPA) or another tax professional before making any decisions regarding filing taxes from overseas.

What is Foreign Earned Income Exclusion?

The Foreign Earned Income Exclusion is one of the most popular digital nomad tax questions. Here’s the good news about it: Not all your foreign earnings are subject to tax!

If you earn income in a foreign country, you can qualify for Foreign Earned Income Exclusion and exclude a certain amount of earnings from your taxable income. For example, for 2023, you can exclude up to $120,000. The Internal Revenue Service (IRS) adjusts this amount annually to account for inflation.

Qualifying for Foreign Earned Income Exclusion when filing taxes from overseas requires you to meet certain stipulations, namely that you must reside in a foreign country or countries for at least 330 days of the year. This is called the Physical Presence Test. Be aware that time at sea on international waters doesn’t count towards those 330 days (strange, but worth knowing!).

Another way to qualify for Foreign Earned Income Exclusion is through the Bona Fide Residence Test. This essentially means you lived and worked in a foreign country for the calendar year.

What Type of Income Can Be Excluded Using the Foreign Earned Income Exclusion?

Love to invest? Then pay attention here!

As the IRS notes, foreign-earned income is “income you receive for services you perform in a foreign country.” That means money made from actual work, whether that’s from teaching English in Japan or from travel writing for a tourism agency in Thailand.

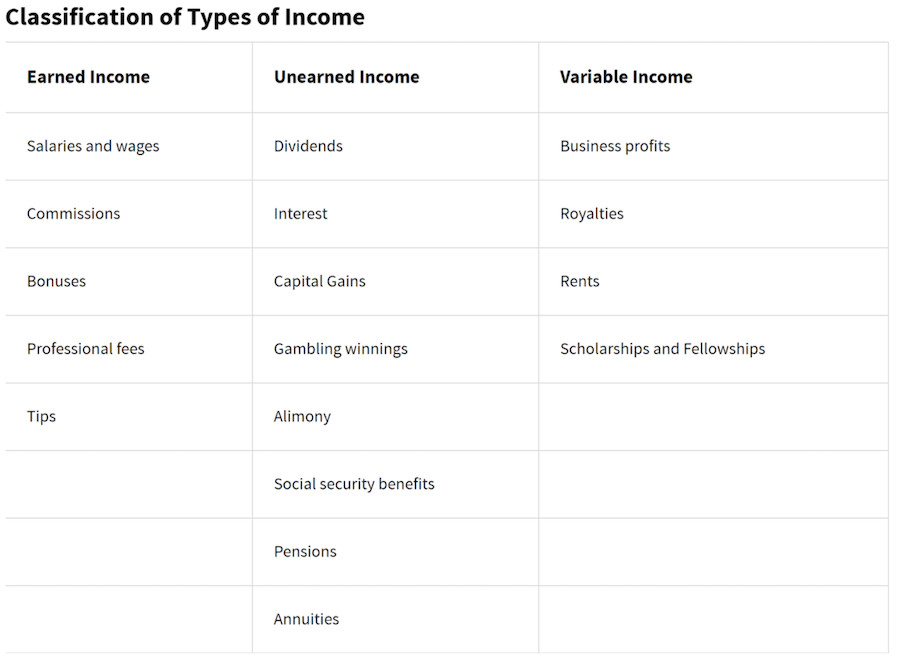

The IRS classifies income into three types of categories: earned, unearned, and variable income. Earned income qualifies for exclusion and variable income may qualify for exclusion, but unearned income isn’t eligible.

For reference, look at the following table from the IRS. It summarizes the categories of foreign income:

For instance, if you made some good money gambling in Macau, you have to pay taxes to Uncle Sam in the U.S. Yes, that makes the celebratory champagne a bit less sweet, but you can’t run from taxes!

How Do Social Security and Medicare Contributions Work When Paying Taxes Abroad?

This is an important digital nomad tax question you may overlook. If you have a U.S.-based employer, they’re responsible for paying Social Security and Medicare taxes for you, whether you’re working in the United States, Italy, or Peru.

If you’re self-employed, which many digital nomads are, you have to pay self-employment taxes. The amount is 12.4% for Social Security and 2.9% for Medicare. You must pay this because of the Self Employed Contributions Act (SECA)—a law that requires S corporations, LLC partnerships, and sole proprietors to pay a 15.3% tax for Social Security and Medicare.

That may seem like a lot, and it is. But think of it this way: Those digital nomad taxes you pay today do return to you in the form of Social Security and Medicare benefits in old age. Sure, Uncle Sam gets to play with your money now, but you do get some return on it!

A word of advice: Plan for this expense before filing taxes from overseas. You’ll also have to pay estimated taxes throughout the year (more on this below).

Do I Have To Pay Social Security Taxes in Two Countries?

When it comes to taxes for expats, one main concern is double taxation on Social Security taxes. This happens when you have to pay Social Security taxes to the United States and the country where you reside.

Thankfully, many countries have a Totalization Agreement with the U.S. This agreement eliminates dual Social Security taxation. For instance, if you reside in Australia, Chile, or Germany, you’re exempt from paying self-employment Medicare and Social Security taxes.

For a list of countries that have a Totalization Agreement with the U.S., visit this SSA webpage. Note this agreement typically applies when you have residence and are working for an employer in that foreign country. If you’re country-hopping, you’ll have to pay Social Security taxes to the U.S., but you won’t have to pay them to a foreign country.

What Is Estimated Tax, and Why Does It Matter for Digital Nomads?

Most digital nomads are self-employed or run their own business. That means income taxes aren’t withheld from their paycheck, like they are when you’re employed with a company. Estimated tax is a method the IRS uses to collect tax throughout the year from self-employed individuals and business owners.

In general, you pay estimated taxes if both of the following apply:

- The amount of income tax you expect to owe exceeds $1,000

- Your withholding or refundable credits are expected to be less than the smaller of the following:

- 100% of your previous year’s taxes

- 90% of your current year’s taxes

To figure out how much your estimated tax is, use the IRS’ self-employed estimated tax and deduction worksheet (pdf). A good rule of thumb for preparing for estimated taxes is to go off what you paid last year. For instance, if you paid $12,000 in income taxes last year, pay $3,000 per quarter to the IRS this year.

So that you don’t get hit with a large tax payment at once, digital nomad tax experts recommend setting aside 25-30% of your income. This ensures you have the funds to pay your estimated tax. You don’t want to take a loan to pay your taxes!

Note: If you’re employed with a U.S. company, make sure your employer withholds more tax from your paycheck. This way, you don’t have to worry about the estimated tax.

Now, you may wonder: How do freelancers pay such taxes while traveling abroad? It’s actually quite simple. Go to the following IRS webpage to submit payment: https://www.irs.gov/payments.

How Do I Prepare for Filing Taxes from Overseas?

If you’re a little behind, you’re not alone. More than 1 in 3 U.S. taxpayers wait until April to file, according to H&R Block. Regardless, now’s the time to get started. Take the steps below:

Get Your Personal Information Together

For paying taxes abroad, you first need certain personal information, including:

- Your social security number or tax ID number

- Direct deposit information (will you get a refund?)

- Note: You can get a refund even if you don’t pay taxes through the Earned Income Tax Credit. This is a benefit for low- to moderate-income individuals. Refer to this IRS’ webpage to see if you qualify.

- Foreign bank account information (if you have one)

- Information about other people on the tax return, such as a spouse and dependents

Calculate Your Taxable Income

Save all your invoices, bank receipts, and other documents that prove your income. If you formally run your own business and have a limited liability partnership (LLC) or S corporation, you can prepare a profit and loss statement to help you calculate your taxable income.

You may have other sources of income, such as capital gains from stock investments, earnings from rental properties, and royalties from content you’ve created. Add these up and have proof of that income as well.

Get the Right Tax Form

Digital nomads should use Form 1040, which is for personal tax returns. You may have to attach other IRS forms to your returns, depending on your situation. These could include:

- Form W-2 from your employer (if applicable)

- Form 1040 (Schedule SE) to calculate self-employment taxes

- Form 1099-MISC from clients who’ve paid you as a contractor

- Schedule K-1 (Form 1065) to calculate business partnership earnings

- Forms to show investment income, such as Form 1099-DIV for dividend income and Schedule D (Form 1040) for capital gains

To be sure you have all the forms you need for filing taxes from overseas, check the IRS’ website and consult with your CPA or tax specialist. When it comes to taxes for expats, each situation differs. Consult with a certified professional for any digital nomad tax questions you don’t fully understand.

Calculate Your Tax Deductions

Want some good news? There are legitimate ways to lower your taxable income!

With many deductions, you can build wealth and get closer to retiring early. For instance, the following investments can be deducted from your taxable income:

- Retirement contributions to a self-employed pension plan and individual retirement account (IRA)

- Health savings account (HSA) contributions

- 529 college savings plan contributions (deductible in some states up to a certain amount)

Plenty of other deductions for necessary expenses exist.

Have a child that goes to daycare overseas? You can deduct up to $3,000 in childcare costs (PDF) per child (up to $6,000 total). We note that this credit can contains numerous criteria that must be met. Review carefully or consult with your tax advisor.

Getting a degree online or at a university abroad? You can deduct eligible education expenses. Use Form 1098-T to claim education costs when filing taxes from overseas.

If you spent a lot on medical and dental care, you qualify for a deduction too. The IRS allows you to deduct medical expenses that exceed 7.5% of your income. If you pay for self-employed health insurance, you can deduct out-of-pocket expenses and potentially up to 100% of your premiums.

Of course, figuring out all these deductions when paying taxes abroad can get complicated. And you don’t want to make any mistakes. Know you don’t have to itemize deductions. For digital nomad taxes, just like everyone else, the IRS allows you to use standard deductions. 2024 standard tax deductions are as follows:

- If your filing status is Single or Married filing separately, then your standard deduction is $14,600

- If your filing status is Married filing jointly or Qualifying surviving spouse, then your standard deduction is $29,200

- If your filing status is Head of household, then your standard deduction is $21,900

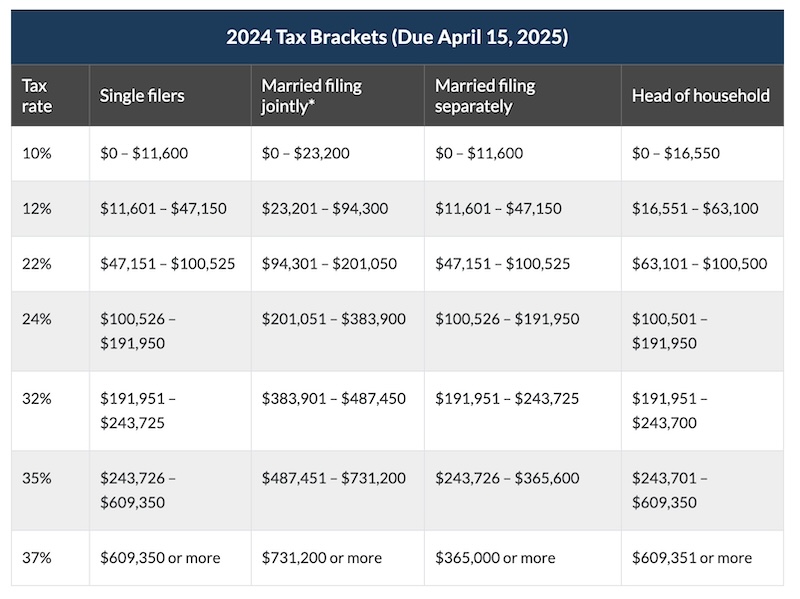

How Much Will You Pay in Taxes as an Expat?

Like with those residing in the U.S., the amount of taxes you pay depends on your tax bracket. To find your tax rate for the 2024 tax filing season, look at the table below:

What’s Your Address When Paying Taxes Abroad?

This is a common digital nomad tax question. And using the address where you receive physical mail in the United States is the most convenient option, whether that’s your home or your parents’ place.

You have another option that could save you money on taxes: a virtual mailbox. These cost a little bit of money but can potentially help you avoid state taxes. Consult with a CPA or digital nomad tax specialist before getting a virtual mailbox.

Making Tax Season Successful as a Digital Nomad

In many ways, taxes for digital nomads are much the same as they would be if you lived in your hometown. But you do have to pay extra attention to things like foreign earned income, dual taxation, your various deductions, and your address. You also have to be diligent.

To make sure tax season goes smoothly as a digital nomad, master the art of recordkeeping. Since you’re bouncing around the world, it’s even more crucial that you have proof of your revenue and expenses. Expats face higher IRS scrutiny when filing taxes from overseas, according to H&R Block research. The best way to avoid any issues or misunderstandings is to have everything you need on hand, from paychecks to medical receipts.

Simply put, preparation is key when paying taxes abroad. If you want tax season to be free of problems, start getting everything ready today. That way, you can get back to what matters: Traveling the world and living that wonderful digital nomad lifestyle!

Disclaimer: The content in this article has been provided for informational purposes only. It should not serve as legal, tax, or accounting advice. Consult your certified public accountant (CP) or another tax professional before making any decisions regarding filing taxes from overseas.

About the Author

Nick Callos has always had a passion for reading, writing, and discovering the new and unknown. Originally from Cincinnati, Ohio, Nick holds a Bachelor’s Degree in English from Boston College. He currently splits his time between his hometown, Chengdu, China, and the open road. A full-time travel writer, Nick hopes his work can inspire others to explore the world more deeply and enjoy the digital nomad lifestyle.Featured image via Unsplash.

Frayed Passport is a participant in the Amazon Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com. We also may share links to other affiliates and sponsors in articles across our website. If you have questions or concerns, please contact us.