Travel Price Inflation Guide: 5 Strategies to Budget Travel

By: Nick Callos

Skip to Section

Article Summary

Travel prices might be playing hardball with your wallet, but you can still see the world without selling a kidney if you know the right moves.

You’ll learn five smart strategies to outsmart travel inflation, including how credit card sign-up bonuses can score you $1,000 in free travel (seriously!), why working remotely might actually save you money while traveling, and how being flexible with your plans can slash costs by 30% or more. The guide also shows you specific affordable destinations that won’t break the bank and sneaky ways to make your home work for you while you’re gone, like Airbnb-ing it or doing a home swap.

- Airline prices dropped 8% in April 2025 compared to last year, so timing matters big time

- Credit card bonuses can net you $500-$1,000 in travel value if you play the game right

- Working remotely in Costa Rica or Croatia could actually cost less than staying home

- Flexibility with dates and layovers saved one traveler $500 on a Boston to Bangkok flight

- Home swaps through platforms like HomeExchange let you stay somewhere for basically nothing

Does inflation have you rethinking your vacation?

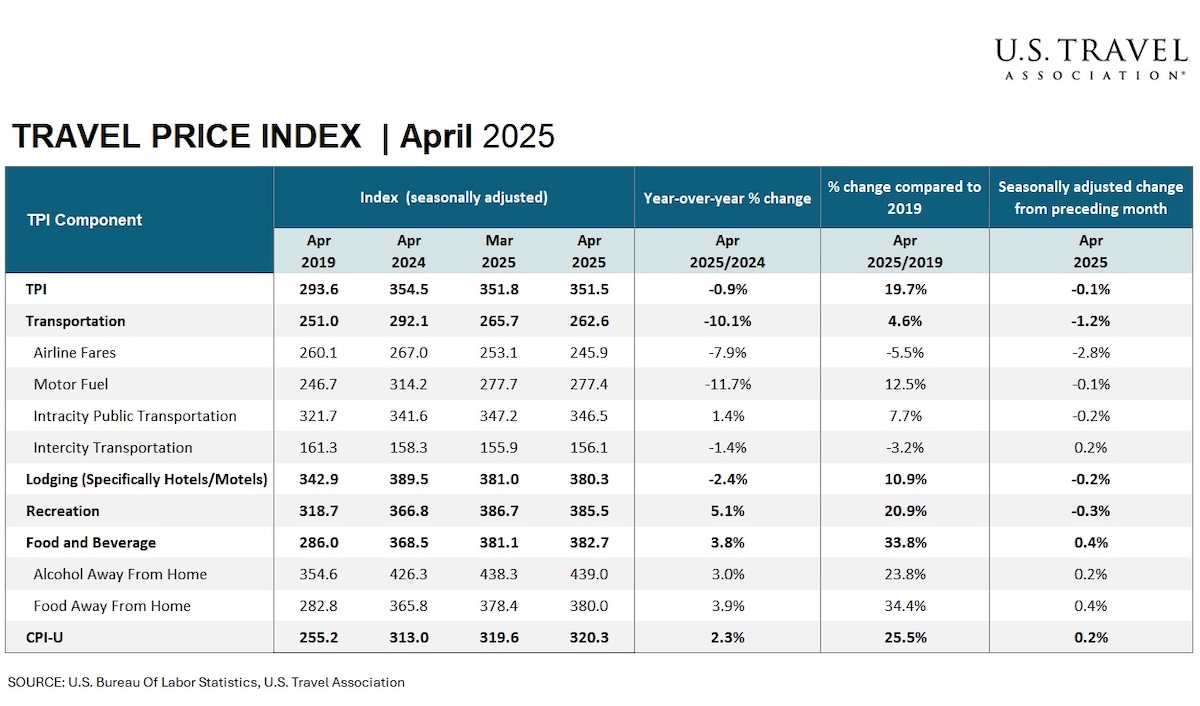

Inflation is often the talk in financial news, after all, and travel is always hit quite hard when inflation rates go up. When the inflation rate hit 9.1% in June 2022—a 40-year high, travel-related goods and services topped the list of fastest price increases. Fortunately we’re not at that rate currently, as you can see in the data below from the U.S. Travel Association’s Travel Price Index:

Overall, travel is less expensive in 2025 than 2024. Prices are higher in almost every category. For instance, airline prices have dropped 8% in April 2025 compared to the same time last year.

But that changes, so if inflation still gets to you or if you’re worried about future prices, we’ve put together this handy guide to travel price inflation. While this article won’t make travel prices magically lower, it will give you a strategy to combat travel price inflation when it happens, and make your trip more affordable — whether you’re going to South America, Asia, or Europe.

Below, we’ve put together 5 strategies to help you beat travel price inflation and lower your vacation costs.

1. Choose an Affordable Destination

If you’re worried about costs, choose a destination that’s fun yet affordable.

Within the United States, for example, there are numerous cities, small towns, and national parks that don’t cost a family of four more than $2,000 for a vacation. If you’re traveling alone or with friends, you can easily spend less than $1,000 on the vacation. Some popular affordable destinations include Grand Canyon National Park (and many other National Parks!), Bar Harbor, the Finger Lakes, St. Augustine, and Colorado Springs.

Globally, there are plenty of affordable places to visit. Countries like Peru, Turkey, and China offer an abundance of history and culture, while also having low-cost, convenient options for lodging, transportation, and dining.

2. Get Points and Miles Through a Credit Card Sign-Up Bonus

If you play the credit card points and miles game, then you’re familiar with this strategy to combat travel price inflation. Many travel credit cards come with sign-up bonuses that offer you $500 to $1,000+ in value. Some bonuses offer enough to get you a round-trip international flight between North America and Asia. These bonuses can get you a free rental car and some free nights at a hotel as well. All that will make your trip much more affordable!

To get the credit card bonus, you typically have to spend a certain amount of money within a few months. Hitting that spending amount can be hard, but if you have a major expense coming soon, like a medical bill, tuition payment, or home repair, you can swipe the card to reach that threshold. Just remember: Be responsible with how you use the credit card. Don’t spend unnecessarily and make payments in full on time.

Deals come and go. To stay updated, check popular points and miles sites like:

- The Points Guy: They break down the dollar value of travel credit card deals well.

- Million Mile Secrets: They update quickly so you can hop on the right offer immediately.

- Nerd Wallet: This reputable site has a wealth of financial advice, in addition to updates on the latest travel credit card deals.

3. Stay Longer if You Work Remotely

Work remotely? Then travel could save you money, even during this era of fast-paced travel price inflation.

At Frayed Passport, we’ve put together tons of guides on how to become a digital nomad. Follow the advice — and you can work and travel the world while spending less than you would while staying home. For instance, our guide on digital nomad visas shows you how to get a remote work visa to various countries. There are numerous affordable destinations, like Costa Rica and Croatia. The money you save on expenses while working for a year there will more than offset the initial expenses of moving.

Want more information on long-term travel? Our digital nomad housing rentals guide teaches you how to save money on lodging while abroad. Our list of the best digital nomad cities highlights affordable, safe destinations with the infrastructure you need to work remotely.

4. Be as Flexible as Possible

To beat travel price inflation, flexibility is one of your main tools. That includes flexibility with destination, dates, lodging, and activities. For instance, you can cook more at your vacation rental and eat at food trucks instead of going out for fine dining. Or, you could camp and stay at budget motels versus 5-star resorts. If you like to meet locals and don’t need luxury, you could use a site like CouchSurfing to stay at places for free.

When it comes to airfare, flexibility can save you hundreds of dollars. It’s a proven tactic to beat travel cost inflation. In my experience, flexibility, especially with the costliest aspects of travel, is one of the best ways to discount your vacation. It can cut your expenses by 30% or more. I once saved $500+ on a flight from Boston to Bangkok just by rearranging my travel dates and choosing a flight with two layovers.

5. Increase Income, Spend Less & Put Your Assets to Work

This sounds like obvious advice, but is worth reiterating. By picking up a side hustle, like running an e-commerce shop or doing travel writing, you can boost your income and save more money on your vacation. You could even sell extra stuff on sites like Craigslist and OfferUp.

In addition to making extra money, you can cut your expenses. You can save on groceries by buying what’s on sale and not eating out as much. You can save on gasoline by walking, biking, and taking public transportation when possible. You can easily cut back on what you spend on clothing by shopping smart. And when it comes to entertainment, find the best free things to do in your town. From outdoor concerts to nature trails, most cities offer plenty of activities that don’t require breaking out your wallet.

Plus, when you go on vacation, you could use your home to make or save money. You could list your home on Airbnb and Vrbo. You could do a home swap through a trusted platform like HomeExchange, and stay at a vacation home for practically no cost.

Beat Travel Price Inflation & Have an Affordable, Memorable Vacation

There are endless amounts of ways to combat travel price inflation. These five strategies provide a good overview of what you can do to get your next vacation within a reasonable budget. From camping and couch-surfing to using airline miles and staying longer, you can beat travel price inflation.

About the Author

Nick Callos has always had a passion for reading, writing, and discovering the new and unknown. Originally from Cincinnati, Ohio, Nick holds a Bachelor’s Degree in English from Boston College. He currently splits his time between his hometown, Chengdu, China, and the open road. A full-time travel writer, Nick hopes his work can inspire others to explore the world more deeply and enjoy the digital nomad lifestyle.Featured image via Unsplash.

Information published on this website and across our networks can change over time. Stories and recommendations reflect the subjective opinions of our writers. You should consult multiple sources to ensure you have the most current, safe, and correct details for your own research and plans.

Frayed Passport is a participant in the Amazon Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com. We also may share links to other affiliates and sponsors in articles across our website.