What’s the Best Semi-Retirement Age? Semi-Retire at 40, 50, or Whenever You’re Ready!

By: Nick Callos

Skip to Section

Article Summary

Semi-retirement lets you ditch the cubicle at 40 with just $300K instead of waiting until you’re 65 with millions in the bank.

Forget the fantasy of full retirement at 40 unless you’ve got $1.25 million lying around. Semi-retirement offers a smarter path: work part-time doing something you actually enjoy, keep cash flowing, and let your smaller nest egg grow while you’re surfing or writing that novel. The guide breaks down the exact math showing how $300K plus part-time income beats grinding until you hit seven figures, plus why working a bit keeps your brain sharp anyway.

- Full retirement needs 25x your annual expenses, so $50K yearly spending requires $1.25 million saved up.

- Semi-retirement cuts that target to around $300K if you earn enough part-time to cover expenses.

- Working part-time prevents cognitive decline while letting your investments compound over 16+ years.

- Five-step process includes evaluating finances, finding enjoyable part-time work, and budgeting for healthcare.

- Best semi-retirement age happens when you’re mentally ready AND the math works, which could be tomorrow with the right setup.

How much to retire at 50? How much to retire at 40? Or what about 35?

These are questions commonly asked by those who embrace the FIRE lifestyle. To retire at 40 or 50 years old is an incredible achievement. It also gives you the chance to pursue passions, spend time with loved ones, and enjoy life while you’re still relatively young and healthy.

But there’s a reality most must acknowledge here…

Full Retirement is NOT Possible or Wise for the Vast Majority

Macroeconomic trends, such as post-pandemic inflation, have made early retirement less feasible. There’s also the importance of remaining cash-flow positive and ensuring you’re financially stable for the next 3 to 5 decades. This is no easy task.

Plus, there is plenty of evidence that continuing to work or study in some fashion helps prevent cognitive and physical decline (like this study from the University of Michigan).

A better alternative is semi-retirement.

What is Semi-Retirement?

Semi-retirement is a period before full retirement. You work part-time, or as much as you’d like, while enjoying your days as if you’re retired. You get to do things you love while escaping the stresses of the 9-5 and the cubicle. You can cover life expenses and continue saving—all the while making the most of your extra time.

- Read our article on the best semi-retirement jobs.

But…How Much to Retire at 40? How Much to Retire at 50?

Let’s get back to the original questions: How much to retire at 40? How much to retire at 50?

The answers vary, but just to give you an idea: Many financial experts say the simple equation to find if you have enough money to retire is take your annual living expenses and multiply by 25.

For instance, if you spend $50,000 per year on living expenses, you’ll need $1.25 million to retire comfortably.

While some can achieve this, it’s difficult for most.

That brings us back to the alternative: If you opt for semi-retirement, your savings target will be A LOT LOWER.

How to Semi-Retire

A guide from SmartAsset advises you take 5 steps to understand how much you’ll need:

- Evaluate your finances: Savings and investments, passive income sources, non-mortgage debts, mortgage, and average living expenses

- Find part-time employment: How much income will you generate? Also, make sure to choose a job you enjoy! We can’t stress that enough.

- Consider healthcare costs: If you can get insurance through your part-time work, you’ll be in good shape (as Medicare will not kick in until full retirement age). If you can’t get insurance through your job, consider how much a Marketplace plan will cost you. Add the healthcare expenses into your living expenses budget. If you put money in a Health Savings Account (HSA) set aside, this will help lower your expenses.

- Build a budget and income plan: Does your income exceed your expenses? If not, you need to close the gap by cutting expenses and/or increasing income.

- One great way to reduce living expenses is geoarbitrage, which is living somewhere less costly. Read our guide on geoarbitrage here. Read our guide on the best geoarbitrage cities in the USA here.

- Review and adjust your plan: Once you get started, careful tracking of your finances ensures you stay on the right track and can continue the semi-retired lifestyle.

How Much to Semi-Retire: A Simple Formula

The answer can vary wildly, depending on your situation. You could semi-retire NOW if income from part-time work and passive sources, such as real estate investments, are enough to cover your expenses and allow for some savings.

But there is a caveat…

You NEED a nest egg of some sorts.

As mentioned above when answering how much to retire at 50 and how much to retire at 40, a simple answer is you need 25x your annual living expenses. This seems like a lot of cash. It is.

However, when you semi-retire and remain cash-flow positive, you give your investments the gift of time. Your financial formula does not have to be complicated. It can be quite simple. Ask yourself these questions to determine how much to semi-retire:

- What are your current total savings and investments?

- What average return on investment can be expected? Be conservative (better safe than sorry!).

- What are your living expenses?

- What income can you expect in semi-retirement?

- How much can you save annually in semi-retirement?

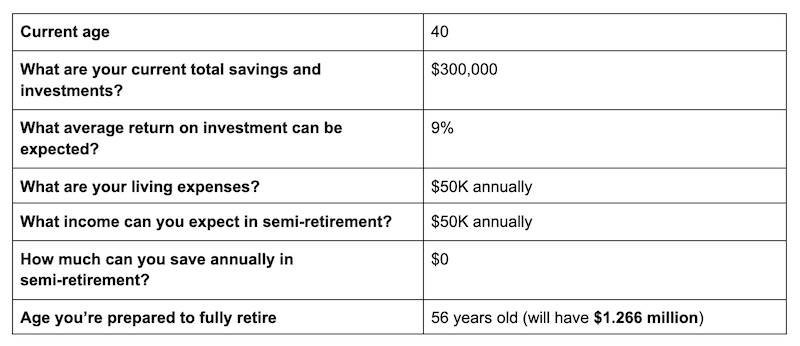

Below, we’ve created an example of a 40-year old looking to semi-retire now. This help you visualize this financial formula for how much to semi-retire, and figure out if you’re ready to semi-retire.

Note: If calculations show the age you’re financially prepared to fully retire seems TOO high, you’re probably not ready to semi-retire. It’s as simple as that.

As you can see, the amount you’ll need to fully retire is MUCH lower for semi-retirement than full retirement.

- To fully retire at age 40 when you have $50K annual living expenses, you need $1.25 million.

- To semi-retire at age 40 when you have $50K annual living expenses, you need ~$300,000 (if you make $50K annually in semi-retirement or enough to break even). And you’ll be financially prepared to fully retire at 56 years old!

What’s the Best-Semi Retirement Age?

Let’s return to the topic of this article: What’s the best-semi retirement age? Is it best to semi-retire at 35, 40, 45, 50, etc?

The best answer is two-fold:

- Semi-retire once you’re mentally, emotionally and physically ready

- Semi-retire once the financial calculation makes sense

In short, the best semi-retirement age is as soon as you’re ready—in all aspects of your life. That could be today, in a few years, or in a decade.

The choice is yours. And the power is in your hands.

Check out our other guides on semi-retirement

- How to Semi-Retire Quickly

- Investments for Semi-Retirement (boost your income through passive sources!)

- Best Semi-Retirement Jobs

- Benefits of Semi-Retirement

About the Author

Nick Callos has always had a passion for reading, writing, and discovering the new and unknown. Originally from Cincinnati, Ohio, Nick holds a Bachelor’s Degree in English from Boston College. He currently splits his time between his hometown, Chengdu, China, and the open road. A full-time travel writer, Nick hopes his work can inspire others to explore the world more deeply and enjoy the digital nomad lifestyle.Featured image by Spenser Sembrat on Unsplash

Information published on this website and across our networks can change over time. Stories and recommendations reflect the subjective opinions of our writers. You should consult multiple sources to ensure you have the most current, safe, and correct details for your own research and plans.

Frayed Passport is a participant in the Amazon Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com. We also may share links to other affiliates and sponsors in articles across our website.