Overemployment: What It Is, How to Be Overemployed, and How It Can Accelerate Your Path to Financial Freedom

By: Nick Callos

Skip to Section

Article Summary

Working two full-time remote jobs can supercharge your savings, shrink your retirement timeline, and give you a serious edge against rising living costs.

Overemployment means juggling multiple salaried jobs—legally and strategically—to boost income and hit financial freedom faster. This guide walks you through how to do it without burning out, breaking rules, or tanking performance at either job.

- Overemployment can help you save six to seven times more annually compared to a single job alone.

- Key tactics include time zone separation, avoiding startups, and staying off LinkedIn once you’re hired.

- You can legally hold two jobs in the U.S., but must avoid conflicts of interest and read every employment agreement carefully.

- Benefits stack up—think double 401Ks, better health insurance options, and more perks across the board.

- By managing two jobs wisely, you could retire 10 to 20 years earlier than the traditional timeline.

Overemployment is the act of working two remote full-time jobs to earn extra income and reach financial freedom. More than simply having a side hustle, being overemployed means having two or more full-time jobs that offer salary and benefits. In the USA, overemployment means having two W2 jobs.

To understand the power of overemployment, consider this:

- James works a web developer job at Company A. They pay him a salary of $80,000. After living expenses and taxes, James can save 10% of that salary annually for retirement. That means he saves $8,000 annually.

- James finds another web developer job at Company B. They pay him a salary of $70,000. Since James lifestyle expenses remain the same, he can save 70% of his gross salary after taxes are deducted. He thus saves $49,000 annually from his second job.

Thanks to overemployment, James saves $57,000 annually for retirement instead of $8,000. That means he’s building wealth at more than 7x the rate he was previously. This will enable him to semi-retire or retire early and travel the world much, much faster.

Now, you see why overemployment is an attractive idea.

While overemployment may sound difficult and potentially hazardous if caught, the fact is any remote worker can do it successfully with the right approach and commitment. In this article, we’ll discuss:

- What is overemployment?

- How to be overemployed

- How being overemployed can get you to financial freedom faster

Photo by Persnickety Prints on Unsplash

What is overemployment?

Overemployment is having two or more full-time remote jobs. The idea driving overemployment is the desire for financial security and freedom. By being overemployed, workers can earn and save more money, offset higher costs of living, improve job and income security and, if successful, achieve financial freedom earlier.

Having multiple jobs became a trend during the COVD-19 pandemic, especially once remote work went mainstream and digital nomads could work full-time jobs from abroad. Overemployment is popular in tech, as demand outstrips supply for software developers and tech professionals. But it’s also become more popular in other fields, including digital marketing, finance, human resources, and more.

Basically, if a job can be done remotely, it’s possible to have two jobs — as long as the demands of one job aren’t too much.

During the pandemic, a thought leader of the movement, Overemployed.com, began providing resources to workers seeking extra income and information on how to land and juggle multiple full-time roles. The movement has since taken off.

- Being overemployed has become so popular that the Overemployed Subreddit has nearly 200K members and counting.

- A recent Yahoo report found 70% of workers are seeking overemployment to combat inflation.

- Resume Builder found that 36% of remote workers have two or more full-time jobs, and 80% have at least a side gig.

Clearly, overemployment is garnering lots of interest as people seek ways to keep up with higher costs of living, build wealth and achieve financial freedom faster.

Photo by David L. Espina Rincon on Unsplash

How to be overemployed?

While there is no set definition for overemployment, being overemployed typically means you make the equivalent of two full-time salaries. It will look different for every individual.

In the simplest sense, overemployment means a copywriter would have two copywriter jobs at two different companies. But being overemployed could also mean:

- Having one full-time job and one or more part-time freelance roles. Combined, you should be making the equivalent of two full-time salaries.

- Having a full-time job and a side business. For instance, you may work as an accountant at a corporation and have a side business that helps individuals file taxes.

- Having a full-time job with a company in the USA and full-time contract role with a company in Europe. This ensures minimal overlap, which makes fulfilling work duties much easier.

The best way to begin overemployment is to start applying to jobs in the same manner you would normally. The good thing is there’s less pressure since you hopefully already have your first job.

Since overemployment requires a careful approach and balance, there are certain tips to follow to ensure it goes smoothly:

- Look for employers in different time zones. This will ensure you don’t have multiple meetings at the same time, as well as you have more time to get your work tasks complete. For example, if Company 1 is in New York City, look for a second job with a company in California.

- Prioritize flexibility. Your second job equals extra cash in the bank. If you have two offers for a second job, take the one that will be easier to manage.

- Pay attention to work culture. Look for warning signs from potential employers. When searching for job 2, ask about meeting culture and what a typical workday looks like. If you feel work will be stressful or you’ll be overseen by a micromanager, consider passing on the job. If you’re unsure, opt for a ‘try before you buy’ approach. Take the job and see what it’s like. If it proves too much, quitting is not as scary when you still have job 1. Pay attention during the interview.

- Generally avoid early stage companies. In general, the advice is to not take a second job at a fast-growing startup where everyone is hustling and working around the clock. While potentially ideal if you’re not in overemployment, startup jobs will add too much stress to your plate.

- Take care of your work duties efficiently. Overemployment is only feasible if you can handle the workload. Find ways to maximize productivity. Do some work at nights and on weekends if possible. Make sure you’re handling all your work obligations, and if it gets too much, you may need to drop a job before your performance impacts a company and your colleagues.

- Stay off LinkedIn as much as possible. LinkedIn is helpful for looking for employment, however, being overemployed presents issues, especially if an employer wants you to list the company on your profile. What you can do is use LinkedIn to get that second job, then deactivate LinkedIn temporarily. Say you’re taking a social media break!

- Be aware of conflicts of interest. While working with another company in the same field may be easier, it may present conflicts of interest and ethics issues. Also, you may violate a non-compete agreement at job 1. Get a job with a company in a different industry if possible. For instance, you could work as a software developer for an e-commerce company for job 1 and for a bank for job 2.

- Act your wage. While going above and beyond is great, you have two jobs when you’re overemployed. Make sure you’re doing your required duties, but be careful about going the extra mile. It could lead to burnout.

- Use references from the past. To avoid any issues or being discovered, it’s recommended to use references from the past (i.e. folks not associated with any current employment of yours).

- Use paid time off (PTO) wisely. When starting job 2, it’s helpful to use PTO at job 1. When job 1 or 2 gets busy, it’s helpful to use PTO at the other job.

How being overemployed can get you to financial freedom faster

Ovemployment can 5-10x your retirement savings overnight. And, if you make the right retirement investments, those savings can compound quite quickly.

Think about this:

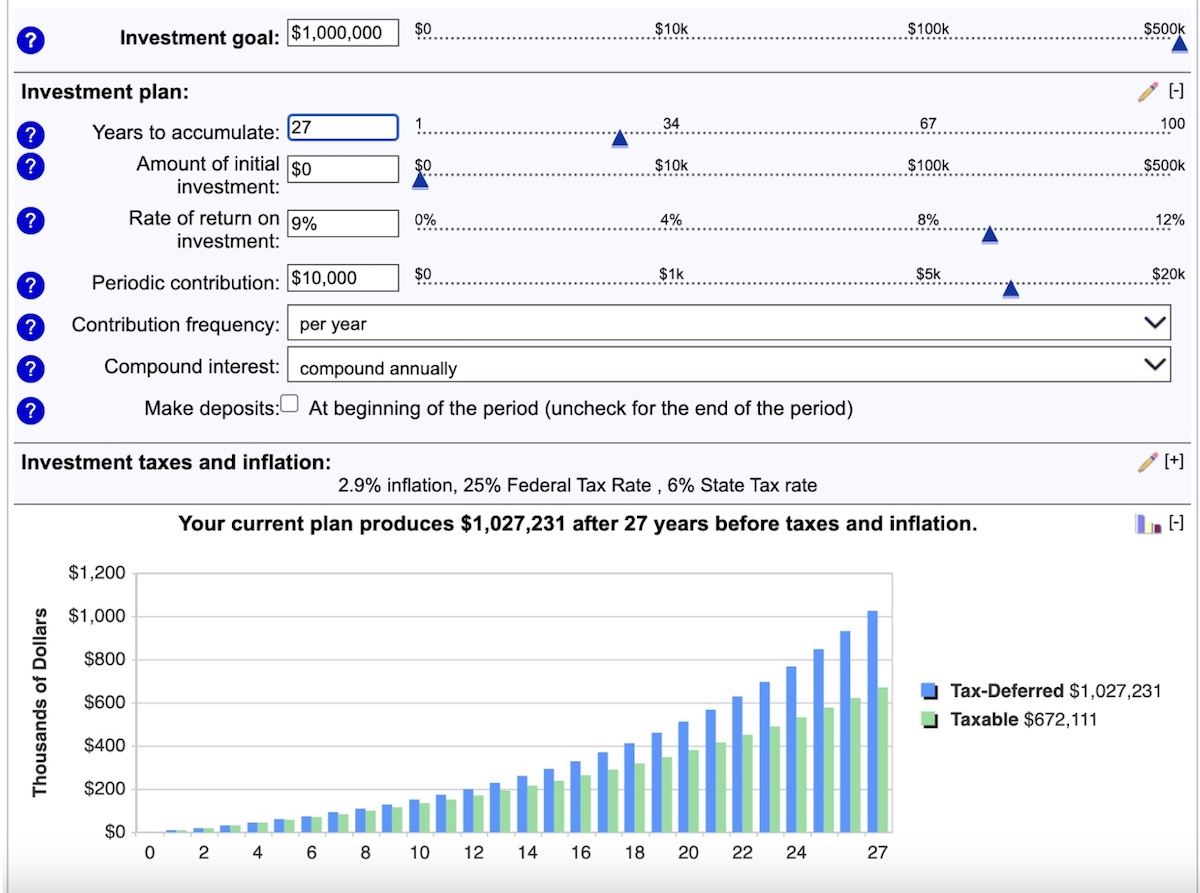

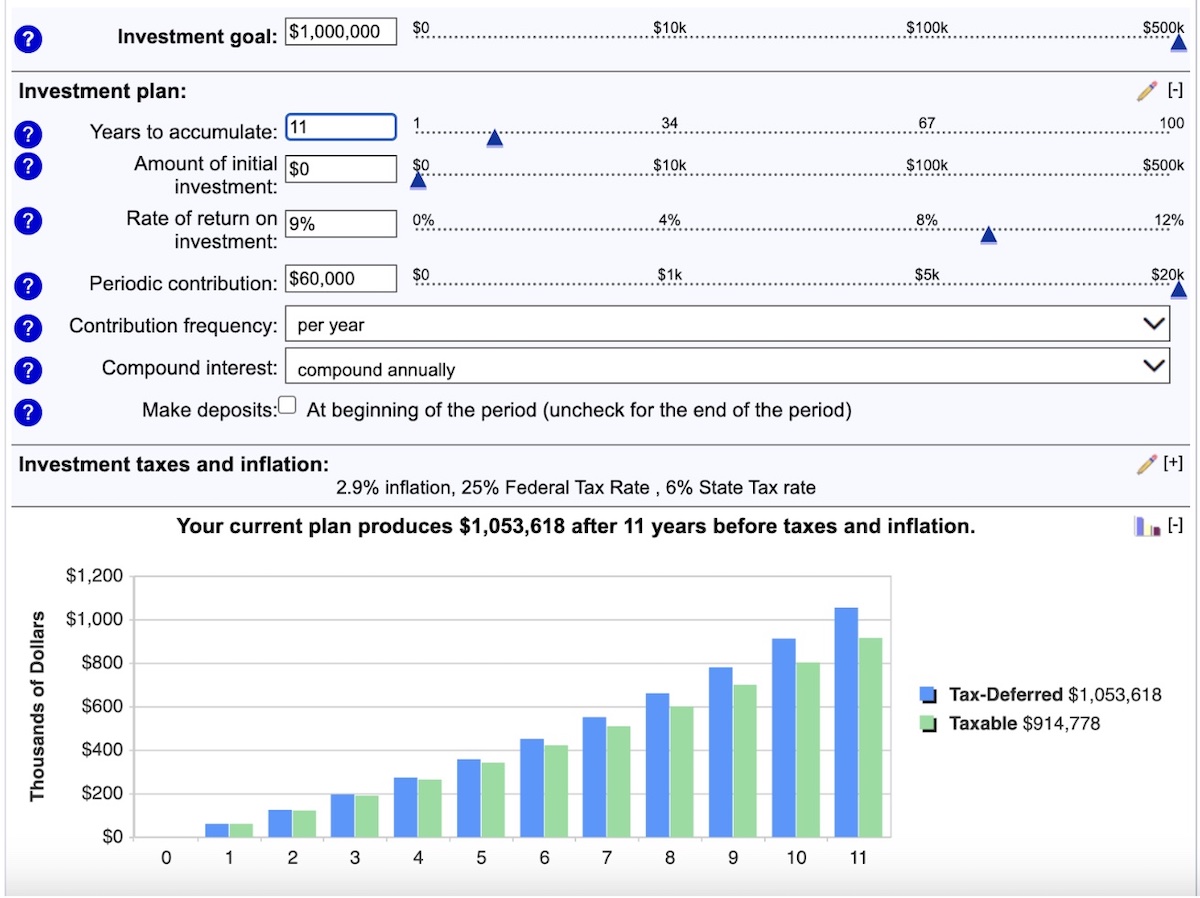

- You only have one job. You save $10K annually for retirement. If you make a 9% return on that money, it would take 27 years to reach $1 million in savings.

- You have two jobs and can save most of that second income. You thus save $60K annually for retirement. If you make a 9% return on that money, it would take only 11 years to reach $1 million in savings.

Simply put, by choosing to be overemployed, you can accelerate your path to semi-retirement or retirement by 10—20+ years. Instead of retiring at 70, you could semi-retire in your 40s and fully retire in your 50s.

In addition, consider these other immediate financial benefits of overemployment:

- You can get another 401K match. Think if you had job 1 matching 5% of your 401K contributions and job 2 matching 4%. That’s a lot of extra savings from your employer’s funds.

- You can get better health insurance. Health insurance premiums add up, but having two options enables you to save money by opting for the better insurance.

- You get double the perks. You could enjoy double the money for gym expenses, home office setup, childcare, cell phone, learning and development, and other full-time benefits companies provide.

Making the leap into overemployment

Overemployment is not for everyone, but it is doable and the financial benefits can be tremendous. The guide here provides lot of tips for getting started and navigating two jobs successfully.

It is also legal to work two full-time jobs in the USA. However, you want to be 100% certain you don’t violate any non-compete agreements or other policies with job 1.

Are you considering overemployment? Are you already overemployed? Feel free to ask us a question, share your experience, or leave advice by joining Frayed Passport on Facebook.

About the Author

Nick Callos has always had a passion for reading, writing, and discovering the new and unknown. Originally from Cincinnati, Ohio, Nick holds a Bachelor’s Degree in English from Boston College. He currently splits his time between his hometown, Chengdu, China, and the open road. A full-time travel writer, Nick hopes his work can inspire others to explore the world more deeply and enjoy the digital nomad lifestyle.Featured image by bruce mars on Unsplash

Information published on this website and across our networks can change over time. Stories and recommendations reflect the subjective opinions of our writers. You should consult multiple sources to ensure you have the most current, safe, and correct details for your own research and plans.

Frayed Passport is a participant in the Amazon Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com. We also may share links to other affiliates and sponsors in articles across our website.